The study was conducted by Element Energy and included 14,000 respondents from the UK, France, Italy, Spain, Germany, Poland, and the Netherlands. You know, the countries that make up nearly 80% of the new passenger car registrations across the EU, UK, and EFTA region. And, folks, the key findings are so optimistic that they’ve really made my day. So, let’s get cracking.

1. Lower upfront cost will make EVs the most in-demand powertrain from 2025

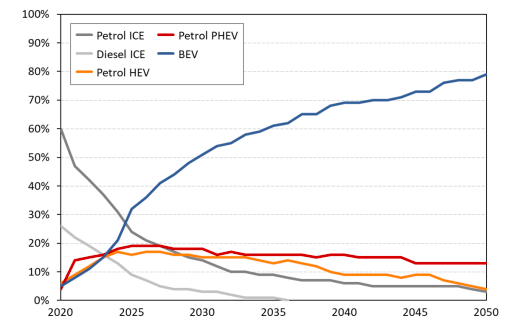

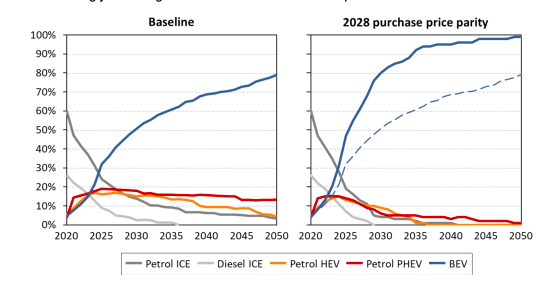

Interestingly, upfront cost was identified as the most influential factor in consumer powertrain decision, while driving range, running cost, and access to charging came as secondary. The study found that rapid growth of EVs is the result of the expected reduction in electric vehicle prices over the coming decade, driven by falling production costs of lithium-ion batteries and the introduction of lower specification, more affordable EVs to the market. Correspondingly, consumer demand for battery electric vehicles (BEVs) is forecast to become greater than that of any other powertrain by 2025. This is projected to reach 50% by 2030, and 80% by 2050. And with BEVs becoming the new normal, from 2027 no other powertrain is expected to hold more than 20% of the market. Under a more optimistic scenario, price parity between BEVs and ICEs is achieved in 2028. And guess what: in that case EV sales would dominate at 80% as early as 2030 and reach 100% by 2050. Check out the following graph comparing the two scenarios:

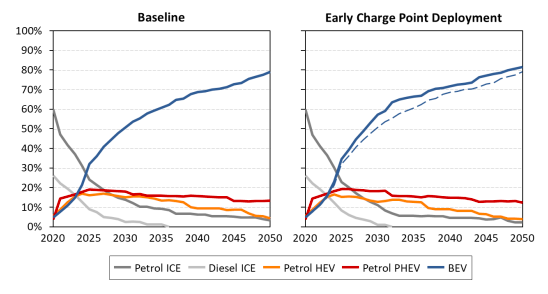

2. Access to public charging doesn’t limit EV demand, but needs to keep up with sales

Most European new-car buyers (59%) have access to private off-street charging, meaning that they won’t rely on public infrastructure for charging. As a result, the study found that improving access to public charging ahead of demand does not, by itself, unlock significant additional BEV uptake. As you can see on the graph below, even if access to public charging infrastructure is guaranteed by 2030, it only increases EV demand by less than 10% within the decade. However, in countries where access to both private and public charging is limited (Spain, Italy, and Poland for example), the deployment of additional infrastructure is expected to unlock significant latent demand. And, according to the findings, consumers who would otherwise buy an EV, won’t do so if they have no access to charging.

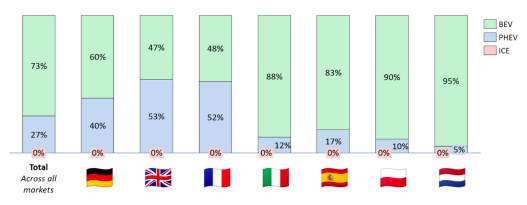

3. BEVs are the preferred powertrain of today’s consumers

Across all markets, the vast majority of respondents (73%) would prefer an EV over an ICE if their properties were equal. That is, upfront purchase cost, running cost, and a 500km range. A little over a quarter would still choose a plug-in hybrid electric vehicle, but according to Element Energy, the trend towards EVs will continue as governments further signal their green intentions, and electric vehicle technology improves and becomes more widespread.

A word of caution

Despite the optimistic outlook, the study stresses that the EV market alone can’t really bring the end of internal engine combustion vehicles. Instead, it calls for strong policy interventions and highlights that an early ban on conventional car sales would increase EV demand much sooner.